The following annual letter can also be read in PDF format below

4th of February 2024

Dear Fellow Compounders,

The idea of writing a comprehensive annual letter has been on my mind for a long time, especially a letter that not only focuses on the principles of sound investing but also on one that goes one level further.

A letter that first and foremost acts as a guide on what principles one must learn, understand, and continuously remember to ensure that one succeeds in multiple domains, including investing but first and foremost, in life. That doesn’t mean I necessarily have succeeded yet, but I think I’m starting to understand what success means on a broader scale and I’m also starting to see the compounding snowball move faster and faster.

While some find comfort in maximizing one particular niche or subset, the real challenge in investing and life is understanding and doing reasonably well over many domains. Few individuals have done this better than the engineer and inventor Leonardo Da Vinci and investor Charlie Munger, and those remarkable individuals will always be the guiding stars for what it means to truly understand something.

Aiming for simplicity was a key topic for both of them, including the mathematical genius Albert Einstein, and I hope that throughout this annual letter, you see that keeping things simple is a core part of my investment strategy, and the reason is plain simple, it works.

“Simplicity is the ultimate sophistication” - Leonardo da Vinci

"Take a simple idea and take it seriously" - Charlie Munger

“Everything should be made as simple as possible, but not simpler” - Albert Einstein

Now, this annual letter is divided into three sections:

Part I, called Principles of Investing, is about the strategy of investing in equities through long-term investing through quality stocks and the mindset I believe one must have to succeed at this. I believe Part II makes more sense after one has read about the strategy because is it interesting to talk about the result without knowing the process? I don’t think so.

Part II is the traditional annual letter commentary that you’re used to from other funds with performance overview and holdings.

Part III, called Principles of Life, is about fundamental principles that anyone can use to navigate life a bit more consciously. I don’t want to pretend that I have all the answers, by far. The thoughts written down are mostly lessons learned after reflecting on mistakes and experiences, and I write this down just as much for me as for you.

I want to thank you for taking the time to read this letter. My hope and wish is that you learn something and bring the lesson forward to someone else. The best thing we can do is to help other people.

Feel free to reach out if you have comments or questions.

Best,

Arne Ulland

LinkedIn: Arne Magnus Lorentzen Ulland | LinkedIn

X: Arne Ulland (@ArneUlland) / X

Mail: arneulland@gmail.com

Part I - Principles of Investing

Principle I - Quality can only be understood through comparison

Torghatten Capital is a high-quality-focused investment fund with a global mandate. That might seem surprising since I’m just a private investor managing my own money. So why call it a fund? The reason comes from one of the best pieces of advice I’ve ever received from a highly successful Finnish investor: If you want to succeed over time, treat investing like running a business.

This means training your mind to think critically about risk and reward while also documenting what you should and shouldn’t do. The real benefit of writing down your strategy is focus. If you’re familiar with the podcast Founders, where David Senra reads hundreds of biographies about investors, founders, and business leaders, one theme comes up again and again: focus. This is an attempt to do just that.

The fund focuses on Quality. The typical definition of quality that nearly everyone uses includes:

Strong competitive advantages.

Trustworthy and honest management with a long-term approach to business operations.

Profitable operations that lead to increased earnings per share and free cash flow per share.

Smart capital allocation, balancing dividends, buybacks, mergers, and acquisitions.

Another example is from the book Quality Investing:

“Three characteristics indicate quality. These are strong, predictable cash generation; sustainably high returns on capital; and attractive growth opportunities. Each of these financial traits is attractive in its own right, but combined, they are particularly powerful, enabling a virtuous circle of cash generation, which can be reinvested at high rates of return, begetting more cash, which can be reinvested again.”

That’s all good, but it feels a bit too simplistic. So let’s take some time to explore what Quality actually means.

First, we all intuitively understand Quality in a broader, more practical sense. A house built by someone with an eye for Quality has a higher chance of surviving a storm because the construction process involves more thought, precision, and resilience.

In investing, many companies perform well when economic conditions are favorable, but most disappear when times get tough. Over decades, only a few survive, and the best firms often seize the opportunity to gain market share during crises. These firms possess something different, something that’s hard to pinpoint just by analyzing a balance sheet or running the numbers.

One reason for this is that Quality might actually be undefinable, yet we recognize it when we see it. Robert Pirsig, in Zen and the Art of Motorcycle Maintenance, wrote:

"Quality cannot be defined. It can only be understood intellectually through the use of analogy."

I believe this means that Quality is why you know a book is great or a piece of music is beautiful before conducting a thorough analysis. You just know it.

There’s something almost magical about the fact that people across different demographics and geographies universally agree that the Harry Potter books are great. This isn’t simply because of the words on the page. High-quality writing isn’t something that can be copied by using the same words, sentences, or even the same story. Quality can only be understood through comparison.

The Quality Triangle

That brings me over to the Quality Triangle which states that 3 things are of utmost importance for the strategy: 1) Historical numbers, 2) Management and 3) Forecastability

Historical numbers:

“History doesn’t repeat itself, but it often rhymes” is a classical saying and while past performance may not be indicative of future results for all stocks, I believe it definitely is for a subset of tested high-quality stocks in the market. Such firms have for decades shown healthy growth, strong gross margins, and operative margins as well as high return on capital employed.

The idea of investing in yesterday's winners is so ridiculously easy to understand but few people accept it because it appears too easy.

Let’s say you own a burger shop, and things are going well. Margins are solid, customers keep coming back, and you’re making a nice profit. The price people are paying is well above what it costs to make the burgers, so money keeps rolling in. Business grows, and with little competition, life is good.

Then one day, on your way to work, you spot a brand-new burger shop right around the corner. There’s a huge line outside. Wait, weren’t you the go-to place in town? Turns out, the new competitor is selling burgers for half your price. So, you do the only thing you can: lower your prices too. A brutal price war begins, and before long, both of you are barely making a profit.

To keep things going, you decide to take on some debt and expand. Even if margins are thin, selling more burgers should help. For a while, it works, profits climb again. Then, out of nowhere, interest rates shoot up, and debt payments start hitting hard. Suddenly, the numbers don’t work anymore. A few months later, you’re out of business. Just like that. That’s the reality of margins, competition, and why having a real business moat is so damn hard.

The point of the story is naturally that a firm that then manages for a very long time to endure that competition despite continued challenges, innovations, and market trends, is not only a good firm but a rare firm, a Quality firm. A firm that continues to do well and it’s likely to continue doing so unless things dramatically change. Hence, historical numbers mean a lot, but you naturally must evaluate the firm because things can change, it just doesn’t happen overnight.

Management

If only one attribute could be written down I’d say clarity stands above all. Clarity means focus, it means quite often that incentives are aligned, that they try to maximize shareholder value for the long term, and that they continually say the same things (values, vision, and ambition) over and over.

One way to understand clarity in terms of management is whether they are saying things in an easily comprehensible way which is possible to understand for most people.

The best way though in my opinion to gauge if management is playing the long game or not is if they are talking about return on capital employed / return on capital invested, and/or if they are allocating capital smartly and silently.

Again it’s pretty simple: Buy shares when the firm appears undervalued, don’t buy shares when the firm is overvalued, and don’t dilute shareholders by raising cash at undervalued levels.

High profitability levels over the long run tend to be the easiest and quickest way to assess if you’re partnering with people who are running the company with a long-term mindset.

Forecastability

What we want here are reasonable business metrics, like good growth, not slow growth, but also not too fast. Preferably, we’re looking for stable margins and revenue growth of around 10-15% per year. Why? Because when things seem too good to be true, they usually are. It attracts too much competition.

You need to be reasonably sure that the firm will operate and be valued similarly to how it has been in the past. Very few firms behave that predictably, hence the importance of this subset of businesses. For most companies, you can’t forecast the future well, but for some firms like Visa, you might be able to provide a decent valuation within a couple of minutes which won’t be terribly off (at least not compared to a traditional DCF).

For example, you can estimate future EPS by taking the expected EPS for the next 12 months, applying an earnings-per-share growth rate over the next five years (based on analyst projections and/or reasonable historical trends), and then multiplying by the expected P/E ratio in five years (using historical averages). And voilà, you have a decent estimate of future EPS. The final step is simply discounting it based on your preferred annual return target.

Let’s talk a bit about what’s reasonable to expect in the valuation of a stock since analyst estimates of a specific price are so commonly used and referenced when making buying and selling decisions.

I often say in interviews that a basic understanding of statistics is one of the most valuable skills to have. Why? Because the world tends to reward confidence, and people assume that the more certain you sound, the more knowledgeable you must be. But reality doesn’t work that way.

A simple example makes this clear. Imagine asking a stranger how long their commute takes. They say 45 minutes. That’s a single point, a fixed answer. Now ask for the fastest and slowest time they’ve ever made the trip. They say 30 minutes at best, 60 at worst. Does that mean there’s an equal chance of the commute taking 30, 45, or 60 minutes? Of course not. The average might be 45 minutes, but most trips likely fall within a tighter range—say, 40 to 50 minutes—following a pattern known as a normal distribution.

Stocks work the same way. Valuations don’t settle on precise numbers; they form a range. The key is recognizing two things. First, precision isn’t the goal when buying or selling stocks. As long as the numbers make sense within a reasonable margin, that’s good enough. Second, when something is trading far outside its expected range, you’re dealing with an outlier, either excessive optimism or deep pessimism has been priced in.

What matters is assessing the situation as it stands. That mindset has served me well when investing. I don’t try to predict where the price will be tomorrow. Instead, I focus on the present and if it looks attractive here and now, I buy.

Mindset

When it comes to mindset, the strategy is quite clear. The fund strongly believes in the power of compounding, so naturally, avoiding disruptions to that power is a top priority. Additionally, opportunity cost, the cost of switching from A to B, is a crucial consideration. It’s essential to have a fair and objective assessment of why and what is gained by replacing something that works with something that might work.

As such, the firm prioritizes inactivity, avoiding the temptation to chase the next big thing or replace a quality company with another. Experience has shown that, in most cases, it would have been better to remain inactive and simply sit on one’s hands rather than engage in unnecessary trading.

That said, this doesn’t mean the fund is completely passive. It operates with a buy-and-reevaluate mentality, meaning that every stock in the portfolio is continuously monitored in terms of valuation, potential forward returns, and risk outlook.

The last point is particularly important: for some reason, many investors assume that when stock prices soar, risk decreases. In reality, it’s the opposite. The further a stock price moves away from its intrinsic value, the greater the risk. This is why consistently measuring the gap between intrinsic value and stock price is essential for any investor, whether active or inactive.

Lastly, it’s important to acknowledge that conviction can sometimes weaken, whether due to personal doubts or changing market conditions. In such cases, Torghatten Capital will always attempt to at least wait one day before taking action to see if the sentiment remains the same. Experience suggests that most things don’t seem as crucial or urgent once a day has passed. This simple pause helps prevent impulsive decisions and reinforces a disciplined, long-term approach.

One more thing - News wants you to react and it doesn’t matter if they are right. I call this The News Matrix. The picture says enough.

Principle 2 - Most of the job is just about keeping things simple and avoiding bad stuff

Simplicity is the guiding star in my investment approach, and what’s easier than making sure you invest in companies that, over the long run, create value? How do you measure that? No need to overcomplicate things.

Value in a money-based system is just the difference between the cost of borrowing money and the profitability of the money you put to work. In other words, the gap between Return on Capital Employed (ROCE) or Return on Invested Capital (ROIC) and the company’s Weighted Average Cost of Capital (WACC).

Unless you enjoy spending hours doing unnecessary Excel calculations with no real practical meaning, just assume the average cost of capital for most firms is somewhere between 8-12%. That’s more than enough to work with. So how do we answer the question about which things to avoid? By making sure we don’t invest in things that over the long run don’t manage to get an ROCE/ROIC above 8-12%. Simple as that.

Things that are difficult to assess

Let’s now list some things that Torghatten Capital finds to be very difficult to assess:

1# Assessing the Value and Investment Risk of Innovative Hyper-Growth Firms

Hyper-growth companies are often valued based on total addressable market (TAM) estimates, which are not only rarely accurate but also fail to account for risk aversion and/or increases in interest rates, which highly affect the terminal value of such firms. Hence, valuations are highly sensitive to macroeconomic conditions and stuff that Torghatten Capital isn’t particularly interested in paying attention to/or finds easy to evaluate. Given these factors, Torghatten Capital sees no reason to engage in such investments.

2# Investing in Commodities, Geared Products, Trading, Derivatives, Cryptocurrencies, Options, Betting on Macro Events, or Forecasting Interest Rates

Torghatten Capital believes in keeping investing simple with a focus on strong fundamentals that hold up over the market cycle and few "exciting" investment alternatives outperform a global index in the long run. Additionally, given that no one can consistently predict interest rates, recessions, or market cycles, there is little reason to believe that I can do so. Therefore, Torghatten Capital sees no reason to engage in these types of investments.

3# Investing in Companies with Revenue or Production Risk Tied to Geopolitical Tension

While such companies may appear undervalued on paper, they are often difficult to hold over the long term due to unpredictable risks. Out.

4# Using Stop Loss or Trailing Stop Loss Strategies

Experience has shown that these methods not only undermine rational decision-making but also make investors hostages to volatility. Torghatten Capital will not use such strategies.

5# Investing in Small Caps with High Customer Concentration

Even when a company appears stable, a high concentration of revenue from a few customers introduces significant, often hidden, risks. One can never fully grasp what’s happening beneath the surface or how market dynamics may impact the firm or its key customers. For this reason, Torghatten Capital sees no reason to engage in such investments.

Let’s list some sectors that aren’t interesting either for the same rationale as explained above, namely poor value creation over the long term

1# Energy (Oil, Shipping, Gas, etc.), Other Commodities, and Banks

These sectors generally lack attractive long-term fundamentals and rarely perform well across a full business cycle. Why? Simply because there’s rarely any moat and thus the profitability over the long run tends to be weak for such industries. The only exceptions here are asset managers, insurance businesses, and equity certificate banks in Norway.

2# Semiconductors

Currently under review. The sector is highly complex and prone to boom-and-bust cycles, as Chip War by Chris Miller illustrates well. The only expectations here are the picks and shovels—companies that provide the critical tools and infrastructure enabling the industry. Think ASML, TSMC, Applied Materials, Lam Research, KLA, Synopsys, and Cadence Design Systems. These firms don’t just ride the cycle, they make it possible.

3# Businesses with High Terminal Value Risk

These are firms that have the potential to generate enormous shareholder value, but investing in them is ultimately a speculative bet. A common pattern among such companies includes target prices significantly above the current stock price, a history of strong price appreciation, and widespread excitement surrounding them. Experience has shown that the terminal value is extremely sensitive to changes in interest rates and it’s very difficult to have a firm opinion and/or confidence in a firm where everyone believes that the future is extremely bright.

Torghatten Capital has historically struggled to assess risk in these cases, with several notable examples:

Opera Software – Misjudged the business outlook entirely and the rumors that stated that Google would acquire them. Massive failure, but early in in the investment career

EMGS – Lacked industry knowledge (and pretty much all knowledge about investing)

Kambi – Underestimated its reliance on the U.S. market and failed to understand the business model (was lazy and didn’t check key customer dependency)

Elkem – Did not fully grasp the operational risks (didn’t have a clue)

Alibaba – Misjudged the risks, lacked understanding of the Chinese market, and had little insight into the business beyond its perceived cheap valuation and general awareness of the founder (looked at the 360+ annual report and thought “there’s no way I’m reading this and definitely no way I can make sure these formalities even matter. Out”)

Principle 3 - Winners keep on winning

The third principle is that some firms simply keep winning even over decades and those are the ones you should partner with. Additionally, some numbers truly tell most of what a Quality investor needs to hear. The following is a list of things that Torghatten Capital likes to focus on when investing in stocks:

1# The preferred business models:

Torghatten Capital favors serial acquirers, investment companies, dominant technology firms, businesses in stable, established industries that provide essential consumer services/products, high-end luxury firms, and firms that dominate their niche. Common attributes here are pricing power, boring operations, long-term mindset with a focus on compounding free cash flow per share, and some with negative net working capital.

2# High profitability matters

High gross and operating margins over the long term above 50% and 20% not only provide a cushion during economic downturns but are also direct proof that they firm is operating with a moat and has pricing power. Further, a high return on capital employed (above 15% is required but ideally 20-30% range) means that the firm is generating value.

3# Competitive advantage (Moat):

All firms should possess pricing power due to moats such as switching costs or network effects. Financial metrics tell the story here.

4# Predictability & financial health

The business must be easy to forecast over the long term and operate with consistent free cash flow generation as well as revenue and earnings stability. The firms should not operate with a high debt level and preferably net debt to EBITDA should be below 4x

5# Masters in capital allocation:

The firms should show a strong track record of prudent capital allocation, whether through reinvestment, M&A, buybacks, or dividends.

6# Shareholder Alignment & Incentives:

Management should preferably have skin in the game, ensuring long-term alignment with shareholders.

Part II - Yearly Review

Performance

2024 turned out to be a strong year for Torghatten Capital, gaining 35.2%. The 10-year performance nearly broke the 15% compounded annual mark but fell just short. From 2015 to 2024, the annual performance has been 14.8% per year, a solid result, but at the same time, I don’t find it fair to celebrate when taking the broader performance into account. Looking at the global index (as measured by the fund KLP AksjeGlobal P, adjusted for NOK), one can note that its return was 32.6% in 2024, with a 10-year return of 14.5%, compared to the S&P 500's 23% gain in 2024 and 12.2% annualized since 2015.

You won’t see this type of comparison among most investors, which raises the question. Why? Why inflate performance when the global market, which operates with significantly less risk than a concentrated portfolio, performs so well? Incentives naturally play a role here. The reality is that most fund managers aren’t primarily focused on delivering solid long-term returns but rather on growing assets under management (AUM) because that’s what drives their revenue.

I’d rather be overly strict than overly generous in assessing performance. However, if one looks at the past 7 years (from 2018 onward), the annual return is 20.03%, compared to 15.59% for the global index. That’s a cumulative return of 259% versus 173% from 2018-2024 versus the global index.

Additionally, my portfolio hasn’t been 100% USD-based. The allocation has been roughly:

30% U.S.

27% Canada

30% Sweden

15% Norway

Comparing 2018 instead of 2015 makes sense since I truly began implementing a quality investing strategy around 2018. Before that, my focus was primarily on dividend and dividend-growth investments. That strategy isn’t bad, but would I conclude that it’s not a strategy for optimizing total return over the long run (total return is the sum of earnings growth and dividend yield).

Most of the dividend growth stocks compound their earnings per share (EPS) at a lower rate than high-quality compounders and eps growth / intrinsic value growth isn’t taxable (before selling that is) as opposed to dividends being regularly paid out. You must also question why the company chooses to pay out dividends instead of reinvesting the cash. Can’t they generate better returns for shareholders internally? All in all, dividend growth investment is a good strategy, but not the best for compounding capital at the highest return possible.

Nonetheless, benchmarking against the toughest possible opponent, the global index, seems reasonable. If one could achieve equal performance while spending time on leisure activities instead, choosing active investing wouldn’t be rational.

However, that’s if you only care about capital appreciation. If you’re genuinely interested in stocks and see it as an exciting life-long hobby, then there are multiple rewards to be earned:

Benefits of Investing

Firstly it's about the insights into psychology and corporate behavior where you learn about behavioral psychology, and become more observant about how people react to crises, how they assess different products, and what makes a company strong or weak.

Secondly, which is the main advantage, is that it fosters a habit of continuous learning where you constantly seek to understand more about the world, what drives value creation, and most importantly, how to reflect on your strengths and weaknesses as a person.

That’s the real benefit of long-term investing. You cannot succeed without performing continued introspection, and figuring out how you can be the best version of yourself, which benefits all areas of your life. To hit the point home, let’s talk about the concept of discipline.

Discipline

Discipline is extremely important for any investor to understand because what matters in investing is two things: 1) You have to make sure that you avoid mistakes and 2) You have to make sure you survive. You probably heard about the legendary race car driver Rick Mears who said “To finish first, you must first finish". What he meant was that consistency, reliability, and avoiding unnecessary risk are key to ensuring longevity which again is the only way one can benefit from compounding as time here is the secret ingredient.

Over the years I’ve come to believe that avoiding mistakes is not about being strict and that people who don’t make many mistakes are some kind of superhumans. What I believe they are though is aware of the fact that discipline isn’t about not acting in a specific scenario one way or another, but it’s about ensuring that you don’t have to make that call at all.

People who are disciplined don’t put themselves into situations where they have to rely on their emotional capability to make the right call. They prepare, plan, and try to avoid such situations altogether because they know that they can’t rely on their instincts to act most beneficially.

For an investor, that means that discipline is about ensuring that you have/do:

A sound & simple strategy based on common sense

Know what you own

Don’t use leverage

Follow the principle of Occam's Razor (few assumptions beats many assumptions)

Don’t try to get rich quickly by following what’s popular at the moment

Ensure that you don’t act when you’re not at your best. That could be because you haven't slept well, are hungry, in need of dopamine, or emotionally unstable, which we all are at times.

If you control these things then you also be “disciplined”.

Now, over to some comments about 2024 and the portfolio holdings.

2024 and portfolio comments

One of my favorite things to do when reviewing a year is to head over to Google and adjust the search filter so that you can only find articles written within that year. Add the term prediction to the search and you’re in for a treat. It’s safe to say that 2024 turned out to be a much better year than what most predicted. The median year-end 2024 forecast for the S&P 500 was 5,068, which implied roughly a 6 percent gain for 2024 according to FactSet. Fun article to look back at here if you want to look at some predictions from Wall Street.

In general, 2024 wasn’t that noteworthy to comment on in terms of turbulence. AI drove a lot of the performance along with the magnificent seven and small caps continued to lag. For Quality investors, the main takeaway was probably that it was once again best to sit on your hands, try to avoid interrupting the power of compounding, and not get caught chasing what could work for what already works.

2024 was a great year for the portfolio holdings

Note: I will use charts from Finchat in the portfolio holdings discussion. I’ve tried pretty much all services and find Finchat to be the best due to their “Segments and KPI” charting option. That alone is a reason to use the service and I highly recommend it. Feel free to use my affiliate account to grab a 15% discount here

Visa (29,1% weight) experienced for a while a storm due to regulatory noise and while I must admit that the prosecutors wrote a very solid piece of research, in the end, I didn’t find many solutions in the paper as an alternative to Visa. That part was pretty weak and there was no chance that a major disruption could happen shortly. When one took the stock price fall into account and compared it to the size of a potential fine, it was pretty clear that the correction was overdone.

In my opinion, Visa continues to be one of the best businesses in the world with extremely solid fundamentals along with solid growth. The case is pretty simple if you ask me: The firm is operating with ROCE at 31%, gross margins at 69%, and free cash flow margins at 27%, and is expected to grow its earnings per share over the long run at 13% annually. The driver? There’s still way too much cash being used in the world and we are nowhere close to having reached maturity in the digital payment sphere.

Feel free to use my affiliate account to grab a 15% discount here

Another holding that is firing on all cylinders is the Canadian vertical market software acquirer Constellation Software. What I admire so much about this company and the best serial acquirers is that they do very complicated things so well, and they do it over time.

Many people have written in long format about this firm and that’s not something I’m going to do here. However, what I want to highlight are 3 things that hit the best serial acquire broadly:

Decentralization is a term often used and people say “they are decentralized” without actually explaining what it means in an operational setting. My understanding of this is that the company units are themselves responsible for creating objectives and key measurements based on what they believe they are capable of achieving. How they achieve this is up to them, but they have to report their progress and their achievements. This again is tracked by senior management to ensure that the business is moving in the right direction and that hiccups and best practices can be utilized efficiently.

The opposite methodology here is that senior management decides which margin the unit should achieve and then just monitors performance periodically. The reason this way often fails is because of the single thing that Charlie Munger repeated over and over “Show me the incentive and I will show you the outcome”.

Without ownership and meaning, it’s hard for large companies to ensure that units perform as they want. Accountability and ownership are the core of decentralization in my opinion.

“In 2003, we instituted a program to forecast and track many of the larger Initiatives that were embedded in our Core businesses (we define Initiatives as significant Research & Development and Sales and Marketing projects). Our Operating Groups responded by increasing the amount of investment that they categorized as Initiatives (e.g. a 3 fold increase in 2005, and almost another 50% increase during 2006). Initially the associated Organic Revenue growth was strong. Several of the Initiatives became very successful. Others languished, and many of the worst Initiatives were terminated before they consumed significant amounts of capital. Examined on a portfolio basis (and to do that we still have to use forecasts, as payback in our business generally requires a 5-7 year time frame) we believe that our Initiatives have generated reasonable internal rates of return. However the Initiative returns have not been as attractive as those generated by our acquisitions. Accordingly, many of our Operating Groups have shifted more of their efforts to growth by acquisition, and have launched increasingly fewer new Initiatives over the last couple of years.

The response of our Operating Groups is what you’d like to see: Now that they have tools for tracking Initiative IRR’s, they are optimizing capital allocation by pursuing better returns in the acquisition market. In principle, there is nothing wrong with this shift. In practice, dramatically fewer Initiatives could eventually lead to a loss of market share. The software business has significant economies of scale, so conceding market share to well run competitors could lead to deteriorating economics. I’m not yet worried about our declining investment in Initiatives because I believe that it will be self-correcting. As we make fewer investments in new Initiatives, I’m confident that our remaining Initiatives will be the pick of the litter, and that they are likely to generate better returns. That will, in turn, encourage the Operating Groups to increase their investment in Initiatives. This cycle will take a while to play out, so I do not expect to see increased new Initiative investment for several quarters or even years” - Constellation Software, Q1 2007

The best serial acquirers are masters of post-merger integration. This means they don’t just acquire a company and let it operate in isolation but rather integrate it in a way that ensures routines quickly take hold and the new company becomes more efficient. They understand that value from an acquisition comes not just from owning the company but from making sure it works smoothly within the existing structure and that they do so fast.

What often happens in acquisitions is that a company is brought in, but the integration process is fragmented. Routine documents end up scattered across multiple SharePoint sites and often without clear owners. Employees are left unsure about what constitutes actual company policy, both at a high level and within their specific units.

The outcome here is that without a clear structure, it becomes difficult to understand how the unit’s objectives align with the broader goals of the company. When this happens, inefficiencies arise, and instead of benefiting from the acquisition, the company struggles with confusion, operational slowdowns, and a lack of “best practices”. They are acquired and might share the same name, but they are not operating as “one company”.

The best acquirers avoid this by having a well-defined integration process that ensures new teams and systems are smoothly incorporated, making sure that routines, policies, and goals are clear from the start. Further, they are godlike in terms of operational efficiency and ensuring value realization post-integration.

Lastly, the best serial acquirers are masters of capital allocation, measured in terms of return on invested capital and they focus on the right things: Increasing the free cash flow to its owners over the long run.

“Our favourite single metric for measuring shareholder returns combines profitability and growth (ROIC + Organic Net Revenue growth)” - Constellation Software

“We keenly monitor our ability to put our shareholders’ Invested Capital to work. In practice, the way we actually measure this is on a project by project basis using conventional after tax internal rates of return (IRR’s). Periodically our board sets a hurdle rate, and we filter both prospective organic growth opportunities and acquisitions based upon those hurdle rates. IRR’s are complex, future oriented, require judgement, and at any one time I’d estimate that we are tracking between 50 and 100 individual projects.” - Constellation Software, Q3 2006

“Our ROIC has bounced around between 15% and 22% (annualised) during the last 7 quarters, with arguably a slight upward trend. In and of itself, that is pretty good. However, there is a unique “kicker” to our business: We use very little capital to grow our business organically. Most of our businesses actually operate with negative tangible net assets. This means that as we grow organically, those businesses consume little or no incremental capital, and may even produce capital in excess of earnings. Unfortunately, organic growth isn’t entirely free. We have to invest money in research and development, sales and marketing, etc. to get this growth. These expense items all depress Adjusted Net Income. The logical consequence, is that to get organic growth, we are willing to accept a lower ROIC” - Constellation Software Q3 2006

This point is short because it’s clear: they have a strong understanding of what the right price is and, just as importantly, when to walk away, even if they have already spent considerable time on the process.

What makes them different from others is that they don’t let sunk costs dictate their decisions. Many companies push forward with acquisitions simply because they’ve already put in too much effort to back out. The best acquirers don’t fall into that trap. They know that no matter how much work has gone into evaluating a deal if the numbers don’t make sense, the right move is to stop. They are strict enough to make that call, even when emotions or external pressure might push them to close anyway.

I believe that the key reason they manage this so well is that they are highly aware of anchoring bias. When companies enter negotiations, there’s often an initial price or valuation that sticks in people’s heads, making it harder to adjust expectations later. Lesser acquirers get stuck on that first number and justify a bad deal just because they’ve already committed mentally (or they randomly pay a price without sticking to a best practice policy). I assume that the best serial acquirers don’t let that happen. They actively work against anchoring bias, staying disciplined and objective, no matter how far along in the process they are.

Feel free to use my affiliate account to grab a 15% discount here

Other comments about 2024

In 2024, I sold $AOJ because I found the management's Q&A responses too vague. If there's one thing I can’t stand, it’s when management fails to clearly articulate their decisions and resorts to endless “and and and” reasoning. To me, that signals a lack of focus. I lost conviction, took my gains, and moved on, reallocating the cash to Visa and Constellation Software.

I also sold Lifco after holding it for several years, as I found the valuation excessive. At 337 SEK, I estimated the forward annual return to be around 6%, which wasn’t compelling enough. The proceeds were moved into Visa.

Additionally, I took a quick profit on $UNH after buying around $450 and selling in the $550–620 range, again reallocating the cash to Visa.

Lastly, I trimmed my position in Investor AB to free up capital for Visa when it was trading at $272.

Portfolio 2025

The weighted portfolio KPIs look like this as of now (9th of February 2025)

Predictions going forward

Visa, Constellation Software, ATD, Novo, Atlas Copco, Investor AB, and Bouvet are all performing well and I don’t see much reason to be pessimistic here. They simply continue to compound at a decent pace and deliver great reports periodically. None of them appear to be overvalued either and I expect most of them to return around 10% annually from here based on the current stock price.

Medistim is a fantastic company, but growth has slowed down and that will be the main thing to focus on going forward in 2025 as they continue to innovate and expand their new product MiraQ™ INTUI Software Platform.

Feel free to use my affiliate account to grab a 15% discount here

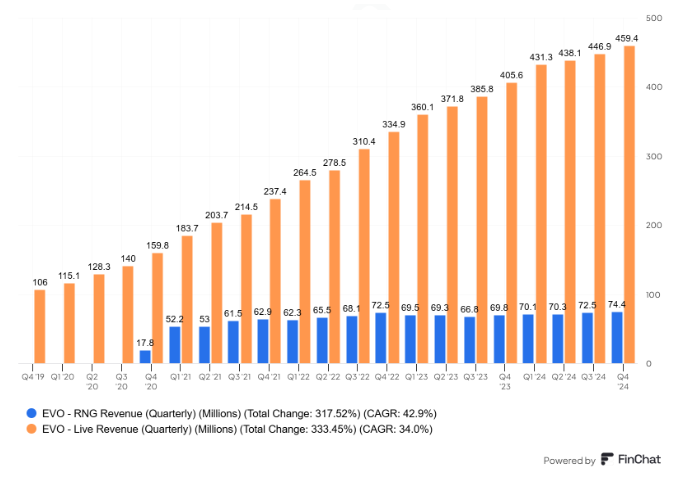

Evolution is naturally a stock I’ve been paying close attention to lately. There’s been a lot of noise, and both investors and analysts are growing concerned that the company’s moat is weakening, with EBITDA margins and growth either slowing or stalling. Right now, I’m focusing on the fundamentals and the potential for growth in Asia.

According to the CEO, growth could normalize by 2025 if the cyberattack issues are resolved. However, it will likely take a few quarters before the company's countermeasures start to show results.

When asked by an analyst, “Does that still mean you expect improvements this year?” EVO responded: “Yes. The underlying market is intact and looking good. And I have no other flavor to give you. So 100% focus is the cyber attack, that someone is stealing our product.”

2025 will be a defining year for value investors in Evolution, either they’ll be very right or very wrong.

My view is that the numbers are simply too attractive to ignore, and it feels like emotions are currently driving the narrative. I wouldn’t be surprised if I ended up buying more in 2025.

Feel free to use my affiliate account to grab a 15% discount here

Part III - Principles of Life

If you’re reading this annual letter I suspect that you’re a driven and ambitious individual with a growth mindset. While that will likely ensure that you succeed in the professional world, the external part which everyone keeps tracking, might not mean you have a good understanding of how to think and feel about your progress.

So, here are a few thoughts that I’ve benefited from and continuously tried to think. This section of the annual letter will grow as the years pass.

A valuable lesson to learn early in life is that your daily mood is closely linked to the quality of your sleep. When you’re not feeling your best, instead of overanalyzing, simply recognize that your feelings may be due to a lack of sleep & leave it at that. It has helped me

You can't find happiness as an end goal and stay there continuously as it's not a static position but rather a dynamic position about something else. The Swedish bestselling author Astrid Lindgren used to say that you need to experience sorrow to feel happiness

I think being happy every day is an illusion & something we've been told is correct. If you can be reasonably happy for the majority of the year, you're doing well. Even Nicolai Tangen said that if you're happy 51% of the year, that's great. Happiness isn't a constant state that we can be in.

It's a dangerous thing to become obsessed with alternative costs & compounding

Try to compound everything in life, not just money, but do so with focus. A mistake I’ve made previously is to try to compound many things at the same time. Choose 1-2 things per year and keep tracking those. Forget about the result. Just focus on the input and the output will take care of itself. You can only improve what you measure

"Watch your thoughts, they become your words; watch your words, they become your actions; watch your actions, they become your habits; watch your habits, they become your character; watch your character, it becomes your destiny." ― Lao Tzu

“What many people see as a three-hundred-page book is often the accumulation of thousands of hours and decades of work. Where else can you get the entire life's work of someone in the space of a few hours? - Charlie Munger

“The true scarce commodity of the near future will be human attention” - Satya Nadella

«I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than they were when they got up and boy does that help, particularly when you have a long run ahead of you» - Charlie Munger

“The more you read, the more you build your mental repertoire. Incrementally, the knowledge you add to your stockpile will grow over time as it combines with everything new you put in there. This is compounding in action, and it works with knowledge in much the same way as it does with interest” - Gautam Raid

Michael Jordan once said, "I've missed more than nine thousand shots in my career. I've lost almost three hundred games. Twenty-six times, I've been trusted to take the game-winning shot and missed. I've failed over and over and over again in my life. And that is why I succeed."

“Having a strong passion for lifelong learning is a durable competitive advantage for an investor. What differentiates successful investors from mediocre ones is passion. To be a truly passionate investor means you are always thinking about the future and the direction of the world. It means you are always enthusiastically observing everything around you. Investing isn't just a process of wealth creation; it is a source of great happiness and sheer intellectual delight for the truly passionate investor” - Gautam Raid

“We are what we repeatedly do. Excellence, then, is not an act, but a habit.” - Will Durant

“If you are in the luckiest 1 percent of humanity, you owe it to the rest of humanity to think about the other 99 percent”. - Warren Buffett

The more decisions you make, the less willpower you have. It's called decision fatigue. Focus on making fewer and better decisions. This allows you sufficient time to think about each decision deeply and reduces the chances of making a mistake.

“The old also have the advantage of knowing which advantages they have. The young often have them without realizing it. The biggest is probably time. The young have no idea how rich they are in time” - Paul Graham

“What should you do if you're young and ambitious but don't know what to work on? What you should not do is drift along passively, assuming the problem will solve itself. You need to take action. But there is no systematic procedure you can follow. When you read biographies of people who've done great work, it's remarkable how much luck is involved. They discover what to work on as a result of a chance meeting, or by reading a book they happen to pick up. So you need to make yourself a big target for luck, and the way to do that is to be curious. Try lots of things, meet lots of people, read lots of books, ask lots of questions” - Paul Graham

Great read!

Beautiful letter.. Especially enjoyed the last section on Principles of Life.