Background

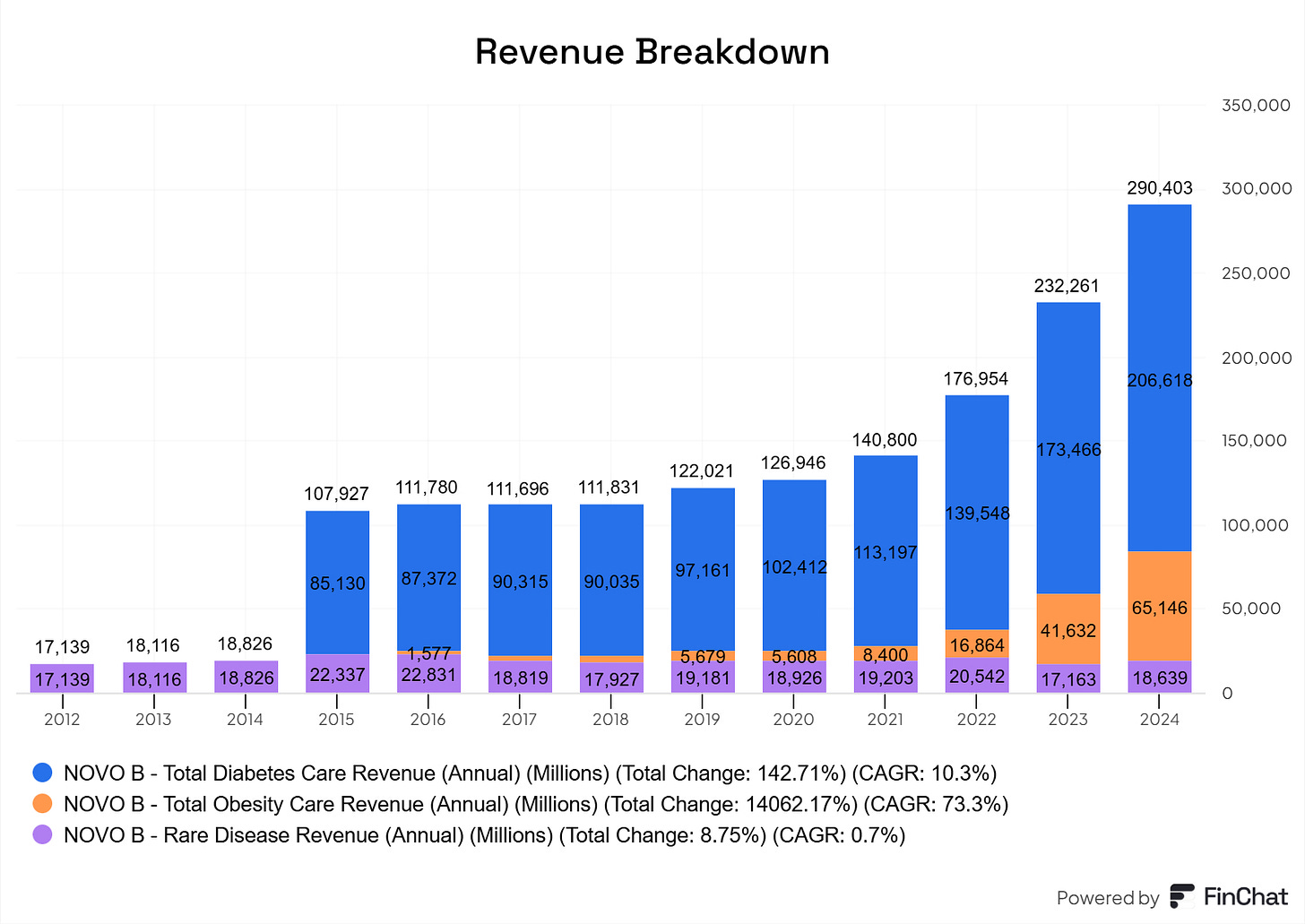

I’ve been fascinated by Novo Nordisk since 2019, the year I wrote my master’s thesis on Nordic family firms. One of our key findings was that a value-weighted portfolio of Nordic family firms generated an average monthly abnormal return of 2.19% from 2000 to 2019 and we discovered that one company stood out and that was Novo Nordisk, the Danish market leader in diabetes care. Due to its substantial size, Novo Nordisk had a dominating effect not only on the Danish sub-portfolio but also on the overall Nordic value-weighted portfolio, significantly shaping the portfolio’s return.

Seeing these results, we had to ask ourselves: how could such a huge firm constantly be undervalued by the market?

After exploring several possible explanations, we concluded that the primary reason for the company’s outperformance was the consistently underestimated growth in global diabetes prevalence.

Initial forecasts at the start of the 2000s significantly understated the scale and acceleration of the diabetes epidemic. In the influential article Global Prevalence of Diabetes: Estimates for the Year 2000 and 2030 (Wild, Green, Sicree & King, 2004), researchers projected global diabetes prevalence to reach 4.4% by 2030, growing from 171 million in 2000 to 366 million people by 2030. Later, Shaw, Sicree, and Zimmet (2010) revised these estimates, projecting that by 2010, 6.4% of the global population or 285 million people, would be living with diabetes, increasing to 7.7% or 439 million by 2030.

However, actual developments outpaced even these updated predictions. By 2019, global diabetes prevalence had already reached 9.3%, affecting 463 million people, ten years ahead of prior forecasts. Newer estimates now anticipate prevalence to rise to 10.2%, or 578 million people, by 2030 (Saeedi, Petersohn, Salpea, Bright & Williams, 2019).

In retrospect, it is evident that earlier forecasts were systematically too conservative. As real-world data consistently surpassed expectations, estimates were revised upward year after year. This had a compounding effect on Novo Nordisk's business outlook, reinforcing its dominant market position and revenue trajectory in ways that investors could not have anticipated ex-ante.

Therefore, while investors likely priced Novo Nordisk fairly given the information available at the time, the firm continued to benefit from these recurring upward revisions in diabetes forecasts. This created a dynamic where the company’s valuation improved incrementally, not due to irrational exuberance or market inefficiency in the traditional sense, but because the underlying market opportunity proved to be significantly larger than originally assumed. It is this structural underestimation of future demand, rather than classic mispricing, that best explains the persistent excess returns observed in our data

Note: I will use charts from Finchat in the portfolio holdings discussion. I’ve tried pretty much all services and find Finchat to be the best due to their “Segments and KPI” charting option. That alone is a reason to use the service and I highly recommend it. Feel free to use my affiliate account to grab a 15% discount here

Will this happen with obesity drugs too? That’s the question. Note that I see the diabetes segment as consumer staples, and obesity as consumer discretionary, meaning consumers don’t necessarily need it. That somewhat changes the perspective.

And That Brings Us to Today…

Or actually, let’s rewind a bit, back to 2024, when Novo Nordisk peaked at 1,005 DKK on June 1st. What was the talk of the town back then, and what were the expectations that could justify the stock reaching an unprecedented P/E of 50?

A list of 10 causes that can summarize the optimism:

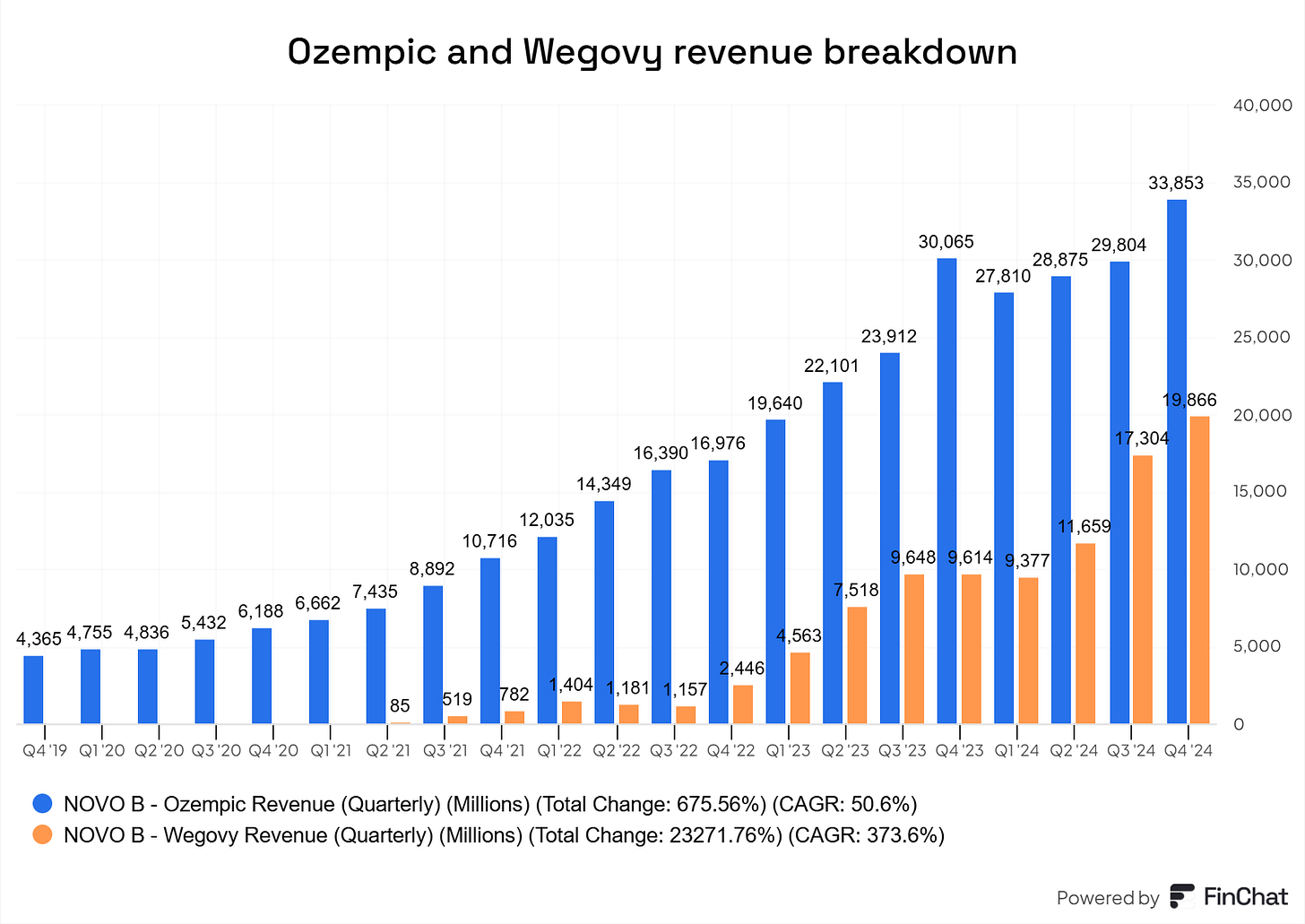

Blowout earnings and raised outlook: Novo Nordisk reported first-quarter 2024 results that beat analyst expectations, with net profit (~DKK 25.4 billion) up ~28% and revenue (~DKK 65.3 billion) up ~22% year-on-year, driven by Ozempic/Wegovy demand. The company nudged its full-year guidance higher (forecasting ~19–27% sales growth, vs. 18–26% prior), exceeding consensus and fueling optimism that growth was outpacing earlier projections.

Surging sales of obesity drugs: Demand for Novo’s weight-loss treatments vastly outstripped expectations. In Q1 2024, Wegovy sales more than doubled (+107% year-on-year) and Ozempic sales jumped ~35%, far above typical growth rates. This extraordinary uptake, so strong that supply had to be rationed in some markets, underscored Wegovy’s blockbuster status and signaled the revenue potential was even higher than investors had anticipated.

Bullish analyst commentary and upgrades: Sell-side analysts and investors grew increasingly positive as Novo’s prospects expanded. Guggenheim analysts noted the new obesity pill “amycretin” will likely “form the foundation” of Novo’s future pipeline, and Berenberg estimated that nearly half of Novo’s lofty valuation was already tied to its promising pipeline of new drugs. Such commentary, alongside price target boosts, confirmed that recent news had shifted expectations upward for Novo’s long-term earnings power.

Massive market potential (TAM) recognized: The total addressable market for obesity treatments became a focal point. Analysts projected the obesity drug market could be worth roughly $100 billion by 2030, a figure higher than previously appreciated.

Positive clinical trial surprises (pipeline): Novo delivered upbeat trial results that exceeded expectations, indicating its pipeline could extend its dominance. Notably, in March 2024 the company announced an experimental oral obesity drug (amycretin) helped patients lose ~13% of body weight in just 12 weeks (about double the 6% loss Wegovy produced in 12 weeks). Investors cheered this early-stage data, the stock jumped over 8% to record highs on the news as it suggested Novo has game-changing follow-up therapies beyond Wegovy, shifting sentiment even more bullish.

Regulatory approvals expanding the market: Breakthrough approvals in new geographies added to the euphoria. For example, at the end of June 2024 China’s regulator approved Wegovy for long-term weight management, opening access to the world’s largest population of overweight individuals.

Capacity expansion and supply improvements: Novo moved to rapidly scale production, reassuring investors that it could meet booming demand. Management highlighted efforts to “beef up” manufacturing, including acquiring three Catalent facilities to boost output and in June announced a $4.1 billion investment in a new U.S. factory to fill Wegovy/Ozempic injection pens. These actions to alleviate supply constraints (which had capped sales) signaled that Novo could deliver more volume than previously possible, encouraging the market to raise its sales forecasts.

Exuberant investor sentiment and market-cap milestones: Novo Nordisk’s weight-loss franchise turned it into a market darling, and success fed on itself. By mid-2024, surging earnings had propelled Novo’s shares to all-time highs, and the company had overtaken LVMH as Europe’s most valuable firm. Novo became a must-own name for growth portfolios.

Shifting medical and payer landscape: Growing evidence of health benefits from obesity drugs also boosted Novo’s outlook beyond prior assumptions. A large 2023 trial showed Wegovy yields a 20% reduction in cardiovascular risk for obese patients, helping recast the drug as a true medical necessity rather than a lifestyle aid. By 2024 Novo was leveraging this data to persuade health insurers that treating obesity would cut heart disease costs. The prospect of greater insurance coverage and broader medical adoption meant the potential patient pool, and long-term sales, could be even larger, contributing to the stock’s strong rise.

Limited competition and protected market lead: Investors recognized that Novo’s obesity juggernaut was secure from near-term competitive threats. Aside from Lilly, no other major rivals were close to launching competing therapies, and Novo’s key patent on semaglutide (Wegovy’s active ingredient) still had years before expiry in its biggest markets (2031 in Europe, 2032 in the U.S.). With generic competition effectively barred in the mid-term and would-be competitors still in trials, Novo appeared poised to enjoy an extended period of market exclusivity. This first-mover advantage was greater than many had initially expected, and it bolstered bullish sentiment that Novo’s high growth and pricing power were sustainable.

In conclusion, a short-term upgrade in sales forecasts, combined with massive capital expenditures to support supply, positive regulatory actions, a huge total addressable market, and limited competition caused investors to bid Novo up to the sky.

What about the massive 60% drop?

The CagriSema Selloff

The main trigger was the disappointing results from CagriSema, Novo Nordisk’s next-generation obesity drug candidate intended to follow up on the success of Wegovy (a weekly injection) and compete directly with Eli Lilly’s Zepbound, also known as Mounjaro. In December 2024, CagriSema delivered an “expected” weight loss of 23%, falling short of the ambitious 25% target. The market reacted sharply and the stock plummeted 27%, wiping out $125 billion in market value.

Then, in March 2025, the REDEFINE 2 late-stage trial delivered another blow. CagriSema achieved a 13.7% reduction in weight, below the hoped-for 15%.

Two key dynamics were at play:

A) Novo made a strategic misstep by setting expectations unrealistically high, which capped potential upside and created a fragile setup where only "perfect" results would be acceptable given the lofty valuation.

B) Investors and analysts were looking for clear evidence that CagriSema could outperform Mounjaro. That confirmation never came. As a result, the consensus shifted: Eli Lilly appeared to be pulling ahead in the obesity drug race, with the superior product and growing market share.

“CagrisSema is only as good as Zepbound, but more complex to manufacture” - Markus Manns, portfolio manager at mutual funds firm Union Investment

Cocktail of bad news

Then came a cocktail of bad news for Novo Nordisk. Zepbound began to outpace Wegovy in U.S. prescription growth, raising investor concerns about whether Novo’s massive capex investments in supply expansion would deliver the expected returns. At the same time, the company faced a string of headwinds: rising price pressure, analyst downgrades, weaker-than-expected sales, U.S. tariffs, and Medicare price negotiations, all of which contributed to mounting uncertainty.

To make matters worse, compounders, which CEO Lars Fruergaard Jørgensen has said could represent 30–40% of the Wegovy market, continued to erode revenues. One could also mention the debate over environmental and political issues tied to the Grenland project in Denmark and its ties to U.S. policy, but frankly, that’s a macro rabbit hole I don’t even want to go down right now.

I’ll also add that the annual general meeting didn’t really help that much either where the charmain of the board clearly stated that they have a rule based approach to capital allocation, which is something I’m not fond of as I tweeted below.

Sound Capital Allocation, Anyone?

One thing I don't like about $NVO is their rule-based, sequential capital allocation mindset, which doesn't appear flexible. They prioritize reinvesting for growth above all else (good), then innovation, then M&A & lastly repurchases. Shareholders would appreciate buybacks here.

Helge Lund, the chairman of the board, explicitly apologized for the stock price development but said that over the long term, due to Novo's investment activities, he expects things to converge. Fine, but to then say they don't expect to do buybacks in 2025 appears illogical.

The way I think about capital allocation is that it's about assessing the choices at hand & focusing on what can create the best value for owners, both short & long term. If it were only about making sure the business stays relevant, then everyone could just invest for growth

Hence, I don't want to hear 'we don't expect to do buybacks in 2025,' as it appears rule-based and not grounded in sound capital allocation principles, where you stay flexible, assess the options at hand, and choose the one that creates the most value.

Eli Lilly’s Orforglipron

Finally, the news on April 17 that truly caused Novo Nordisk to crash was Eli Lilly’s announcement of positive results for its oral pill, orforglipron (“orfo”), which showed highly competitive efficacy. In the Phase III Achieve-1 trial for patients with type 2 diabetes, participants lost up to 7.9% of their body weight over a 40-week period using the 36 mg dose. These results outperformed Novo Nordisk’s Rybelsus (14 mg oral semaglutide), once again demonstrating that Eli Lilly is strengthening its market position in the oral segment (from what I’ve seen, this is what most analysts care about. Eli Lily now has a scalable oral obesity drug while Novo doesn’t).

What now? - The Investment Thesis

There are many things to say here, and they somewhat differ in category.

Risk goes up when fundamentals don’t follow the price

Risk increases as stock prices rise, because expectations rise too, leaving little room for error. That’s essentially what happened in December with the CagriSema results. Novo Nordisk set themselves up for disappointment by guiding for 25% efficacy, which was very ambitious. That’s on them, and I believe some of the negative price reaction could have been avoided with more cautious guidance.

Compounders easy off, Hims & Hers partnership, Guidance reinstatement

The issue with compounder, so-called “copycat” producer, is starting to ease. For context, U.S. compounding pharmacies have been legally permitted to produce copies of Novo Nordisk’s obesity drug Wegovy and diabetes drug Ozempic (both chemically known as semaglutide), due to a drug shortage ruling by the FDA. This situation has limited Novo’s sales growth (and $LLY), as these compounders have accounted for an estimated 30–40% of total sales, according to CEO Lars Fruergaard Jørgensen.

However, the FDA has now declared the shortage over and given compounders until May 22 to stop selling copies of the drug. Novo (and $LLY) has also taken legal action against several compounder, not just on the basis of patent infringement, but also because some of these unregulated versions contain non-FDA-approved ingredients.

Adding to the momentum, Novo announced a partnership last week with Hims & Hers to sell Wegovy directly to consumers, which should further boost sales growth in the second half of 2025 and beyond. While this won’t impact Q1 results, one could argue that H2 Wegovy sales are now expected to exceed what analysts assumed just months ago (when they were quite pessimistic)

This brings us to guidance reinstatement, something many analysts have been very concerned about. The company previously guided for 16–24% revenue growth and 19–27% operating profit growth, but investor confidence has wavered amid regulatory and pipeline uncertainty.

Notably, under Danish financial regulations, Novo Nordisk is required to update the market as soon as management determines that the midpoint of any new full-year projection falls outside the previously communicated range (as highlighted by TD Cowen). Since no such announcement has been made yet and Q1 results are tomorrow, I expect guidance to be reaffirmed, and that could serve as a short-term catalyst for the stock price.

More importantly, it signals that, over the long term, the FDA clearly favors established players like Novo Nordisk and Eli Lilly. That regulatory preference is no surprise, but it reinforces the expectation of consistent, protected obesity medicin.

Misconception: “One Winner Takes All”

Many have used this argument, and I’ll use it too, because I think it’s true: the obesity market is not a “winner-takes-all” scenario. Eli Lilly and Novo Nordisk have competed side by side for years, and they will continue to do so. Right now, the market seems to be painting an overly negative picture, likely driven more by the stock’s recent decline than by any fundamental shift in long-term dynamics.

I’ve been investing for 15 years, and if there’s one pattern that holds, it’s this: analysts, the media, and investors are rarely balanced. They’re either too optimistic or too pessimistic, there’s hardly ever a middle ground. And in my view, that’s exactly what’s happening here.

Is Eli’s Pipeline Really That Much Stronger?

Let’s start by comparing some data of Novo Nordisk’s Ozempic drug 1 mg and 2 mg versus Orfo 3 mg, 12 mg and 36 mg.

We note that Orfo 36 mg delivered the highest weight loss at the end of the study, confirming it as a strong contender in the obesity drug landscape. However, it's important to consider the side effect profile: 14% of patients experienced vomiting, 26% had diarrhea, and 8% discontinued treatment, figures that may weigh on long-term adherence and market acceptance.

Now, if we compare Novo Nordisk’s oral semaglutide 14 mg and 25 mg with Orfo, as highlighted by Nordea, the data shows comparable efficacy, which significantly narrows the perceived gap between the two treatments.

Ultimately, this isn’t just about weight loss efficacy, it’s also about the ability to safely and reliably meet global demand over the long term. On that front, I believe Novo Nordisk remains highly competitive with Eli Lilly, thanks to its decades-long track record in scaling complex treatments, its deep manufacturing expertise, and its position as the market leader in diabetes. The long history of direct competition between these two companies only strengthens Novo’s ability to execute in this new and rapidly growing obesity market.

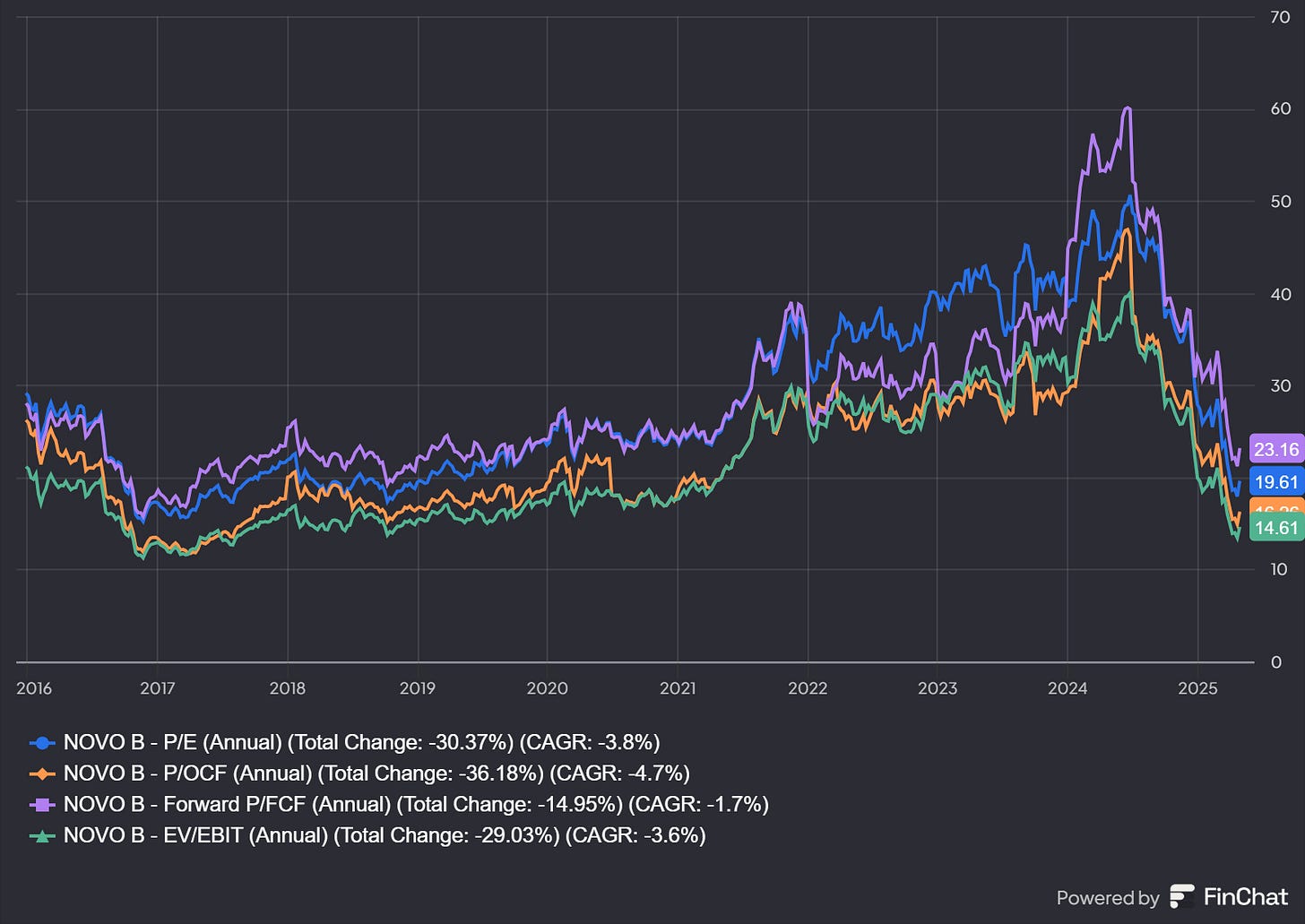

Valuation too attractive to ignore

Reversed DCF

Using a reversed DCF with a 12% desired return (discount rate), I find that Novo Nordisk needs to grow its free cash flow (adjusted for stock based compensation and growth capex) at roughly 11% annually over the coming decade. That seems plausible given the company's current growth phase and the rapid expansion of the obesity treatment market. It’s also broadly in line with historical averages, and analysts are currently projecting around 15% growth with 20% growth the next 5 years.

3 Stage DCF

Running a three-stage DCF with a 12% discount rate, assuming 20% growth in years 1–5, 6% in years 6–20, and 3% in perpetuity, I arrive at an equity value of approximately DKK 2,800,000, translating to a share price of about DKK 630 (861 DKK if WACC is 10% instead and 430 DKK if requiring 15% return).

If we want to take a stricter view, applying a 15% discount rate, assuming 15% growth in years 1–5, 6% in years 6–20, and 2.5% in perpetuity (to align with GDP growth), we get a fair value of around DKK 350 , which interestingly was “close” to the recent bottom.

A more balanced “base case,” more aligned with consensus expectations, would use a 10% WACC, 15% growth in years 1–5, 4% in years 6–20, and 2.5% in perpetuity. This yields an equity value of DKK 2,600,700, translating to a share price of roughly DKK 586.

Rochon Method

If one uses the Rochon method with “normalized” P/E of 25 and expected growth rate at 15% the next 5 years, one can see that a 15% return could be doable at 570 DKK and 12% at 650 DKK.

Multiples

As for multiples, on that front, Novo Nordisk actually looks attractive.

In conclusion:

No matter how I look at Novo, it appears quite cheap. I’ve been buying on the way down and doubled my position under 400 DKK. It is my largest position now.

You’ve probably noticed I haven’t spent much time here on historical metrics like ROE, ROIC, and the like. That’s intentional. There are already countless posts and tweet threads covering those numbers, and to be honest, I find them a bit backward-looking and, frankly, boring. Of course, they matter and tell you a lot about a company’s underlying quality. But any real analysis should also include operational context, what’s happening on the ground, what’s driving sentiment, and how the company is positioned going forward.

Let’s see how things go tomorrow. I don’t expect a great report, but want to hear that guidance is restated and how Novo will tackle supply issues.

Best

Arne Ulland

I did a deep dive on Novo Nordisk last week and reached a very similar conclusion - way too cheap, especially relative to Eli Lilly: https://rockandturner.substack.com/p/is-novo-nordisk-better-than-eli-lilly

You likely receive hundreds of pitches.

This isn’t one of them.

Hello @Arne Ulland,

Share deep respect for what you have built here.

I am the Founder and Steward of the 100x Farm.

The 100x Farm is a quiet strategy sanctuary for investors and capital stewards with long memories and longer horizons.

No noise. No dopamine. No trend-chasing.

Just deep-cycle clarity earned slowly, shared rarely.

We don’t believe in inbox conquest.

But if the idea of sowing $10,000 seeds to harvest $1 million trees over 20- 30 years feels familiar,

you and your patrons may already belong here.

What if the next 100x isn’t a stock but a forgotten business model hiding in plain sight?

Every thesis is backed by real capital, filtered through over 100 long-cycle lenses before it earns a word.

And if nothing else, this may help you filter what isn’t worth your time.

No urgency. No ask.

Only signal.

Warmly,

The 100x Farmer